The below is general information. Not legal advice

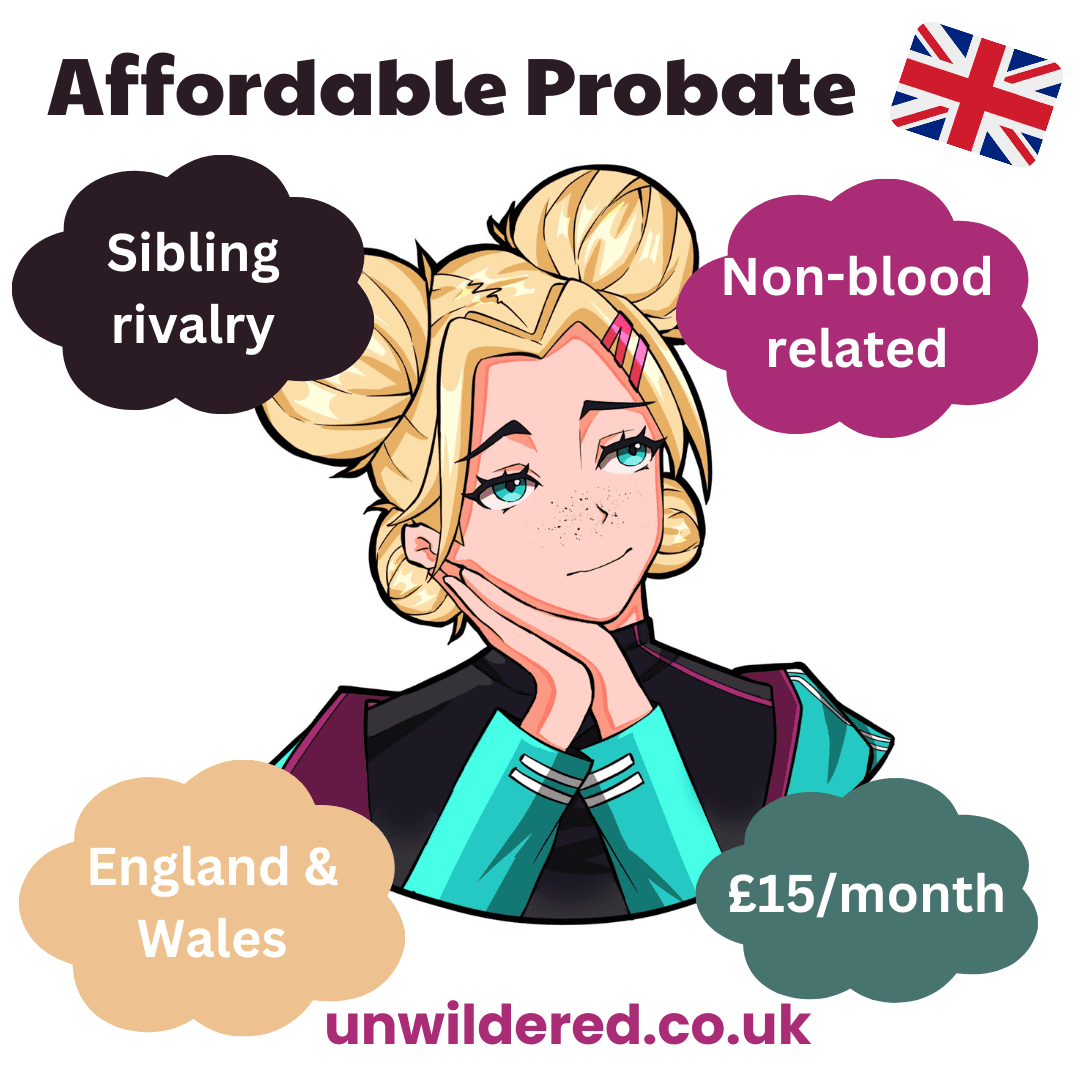

Probate and inheritance disputes can be emotionally and legally challenging, often arising during a time of grief. Understanding the process and potential conflicts can help you navigate these situations more effectively. Here’s how Caira can help you for just £15/month:

-Upload relevant documents: Will, deeds, emails, medical notes

-Tell Caira what you would like to achieve and what your concerns are.

-Read Caira’s response. Ask for clarification or draft statements or emails 24/7.

Sign up for a free draft now: https://caira.unwildered.co.uk

What is probate?

Probate is the legal process of administering a deceased person's estate, ensuring debts are paid, and distributing the remaining assets according to the will or intestacy laws if no will exists. The executor, named in the will, is responsible for managing this process. If there is no will, an administrator is appointed.

Common Inheritance Disputes

Inheritance disputes can arise for various reasons, often rooted in emotional, financial, or legal complexities. Here’s a more detailed look at some common types of inheritance disputes:

1. Missing or Contested Wills

Missing Wills: When a will cannot be located, the estate is typically distributed according to the rules of intestacy. This can lead to disputes if family members believe there was a will that reflected different wishes. Searching for a will might involve checking with solicitors, banks, or among personal papers.

Contested Wills: A will can be contested on several grounds:

Undue Influence: This occurs when someone exerts pressure on the testator to change the will in their favour, compromising the testator's free will.

Lack of Capacity: If the testator was not of sound mind when making the will, it can be challenged. This often involves medical evidence to prove the testator's mental state.

Fraud or Forgery: Allegations that the will was forged or that the testator was deceived into signing it can lead to disputes.

Improper Execution: A will must meet certain legal requirements to be valid, such as being signed in the presence of witnesses. Failure to comply can render it invalid.

2. Executor Misconduct

Breach of Fiduciary Duty: Executors have a legal obligation to act in the best interests of the beneficiaries. Misconduct can include mismanaging estate assets, failing to distribute assets in a timely manner, or acting in a biased manner.

Lack of Transparency: Beneficiaries may feel aggrieved if the executor does not keep them informed about the estate’s administration. This can lead to suspicions of wrongdoing.

Conflict of Interest: If an executor stands to benefit personally from decisions made during the administration of the estate, this can lead to disputes.

3. Family Disagreements

Perceived Inequities: Disputes often arise when family members feel that the distribution of assets is unfair. This can be particularly contentious if verbal promises were made that differ from the will’s provisions.

Blended Families: In families with stepchildren or multiple marriages, disputes can arise over who is entitled to what, especially if the will does not clearly address these relationships.

Emotional Factors: Grief and loss can exacerbate tensions, leading to disputes that might not have arisen under different circumstances.

4. Claims Under the Inheritance (Provision for Family and Dependants) Act 1975

Eligibility: This Act allows certain individuals to claim if they believe the will or intestacy does not make reasonable financial provision for them. Eligible claimants include spouses, former spouses, children, and anyone financially maintained by the deceased.

Reasonable Financial Provision: The court considers several factors when determining what constitutes reasonable provision, such as the claimant’s financial needs, the size of the estate, and the obligations the deceased had towards the claimant.

Impact on Estate Distribution: Successful claims can alter the distribution of the estate, potentially reducing the shares of other beneficiaries.

Steps to Resolve Disputes

Communication: Open and honest communication among family members can sometimes resolve misunderstandings before they escalate.

Mediation: This is a less adversarial process than court proceedings and can help parties reach a mutually agreeable solution. It’s often quicker and less expensive than litigation.

Legal Action: If disputes cannot be resolved through mediation, legal action may be necessary. This can involve challenging the validity of a will or the actions of an executor.

Practical Tips

Locate the Will: Ensure you have the most recent and valid will. If it’s missing, check with solicitors, banks, or among personal papers.

Understand Your Rights: Familiarise yourself with your rights as a beneficiary or potential claimant. This includes understanding the terms of the will and the legal grounds for any claims.

Document Everything: Keep detailed records of all communications and transactions related to the estate. This can be crucial if disputes arise.

Signup to chat with Caira now. The free trial doesn’t require a credit card: https://caira.unwildered.co.uk

EXAMPLE:

Scenario 1: Sibling Dispute Over Inheritance

Example question: My father, who lived in London, passed away last month, leaving behind a substantial estate valued at approximately £1.5 million, including a family home worth £800,000 and various investments. He had a will that stated his assets were to be divided equally among his three children, including myself. However, my older sister, who has always had a contentious relationship with me and our younger brother, claims that our father verbally promised her the family home before he died. She insists that he intended for her to inherit it solely, despite the will stating otherwise. She is now threatening to contest the will, claiming that our father was not in a sound state of mind when he made it. What are my rights, and how can I protect my share of the inheritance?

Answer: In this situation, the will is the primary legal document that dictates how your father's estate should be distributed. If the will clearly states that the assets are to be divided equally among the three children, this is the legal framework that should be followed.

Verbal Promises: While your sister may assert that your father made a verbal promise regarding the family home, such claims can be difficult to substantiate in court, especially when there is a written will that contradicts those assertions. The law generally favours written documents over verbal agreements, particularly in matters of inheritance.

Challenging the Will: If your sister decides to contest the will, she will need to provide substantial evidence to support her claim. This could include witness statements from individuals who were present during discussions about the estate or medical records that demonstrate your father's mental state at the time the will was created. The burden of proof lies with her to show that the will does not reflect your father's true intentions.

Executor's Role: As a beneficiary, you have the right to be informed about the estate's administration. If your sister is the executor, she has a fiduciary duty to act in the best interests of all beneficiaries. If she fails to do so, you may have grounds to challenge her actions.

Documentation: It is crucial to gather all relevant documentation, including the will, any correspondence regarding your father's intentions, and any evidence that supports your position. This will be essential if the matter escalates to court.

Ultimately, the will should be upheld unless there is compelling evidence to suggest otherwise. Your rights as a beneficiary are protected by law, and you should be able to assert your claim to an equal share of the estate.

Scenario 2: Non-Blood Related Person Claiming Inheritance

Example question: I lived with my late partner, Margaret, for the past seven years in her home in Manchester. Margaret passed away recently, and I am devastated. We had a close relationship, and I was her primary caregiver, especially after she was diagnosed with a chronic illness that left her with significant mobility issues. I helped her with daily activities, managed her medications, and provided emotional support. Although she had a will that left her estate, valued at around £500,000, to her two biological children, I am now claiming that I was financially dependent on her and that I should receive a share of her estate under the Inheritance (Provision for Family and Dependants) Act 1975.

Margaret often expressed her desire for me to be taken care of, especially given my own health challenges, which include a disability that limits my ability to work full-time. I contributed to household expenses and was reliant on her for financial support. However, her children are now contesting my claim, arguing that I was not a dependent and that the will should stand as it is. What are my chances of successfully claiming a share of her estate?

Answer: In this case, your claim under the Inheritance (Provision for Family and Dependants) Act 1975 hinges on several key factors:

Eligibility: The Act allows individuals who were financially dependent on the deceased to claim if they believe the will does not make reasonable financial provision for them. Since you lived with Margaret and provided care, you may have a strong case for dependency, especially if you can demonstrate that your financial situation was significantly impacted by her passing.

Financial Dependency: You will need to provide evidence of your financial dependency on Margaret. This could include bank statements showing shared expenses, records of payments made to you for your contributions, and any documentation that illustrates your reliance on her for financial support. Your health challenges and inability to work full-time can further substantiate your claim.

Margaret's Intentions: If you have any written correspondence, such as letters or messages, where Margaret expressed her wishes regarding your care after her death, this could strengthen your case. Testimonies from friends or family who can attest to her intentions may also be beneficial.

Impact on Your Life: The court will consider your financial needs and the impact of Margaret's death on your living situation. If you can demonstrate that you would face financial hardship without a share of her estate, this will support your claim.

Challenging the Will: While Margaret's children may argue that the will should stand, they will need to provide evidence to counter your claims of dependency. If they cannot substantiate their position, you may have a stronger case.

Ultimately, your chances of success will depend on the evidence you can provide regarding your financial dependency and Margaret's intentions. The court will assess whether the provisions made in the will are reasonable in light of your circumstances.